Vision and Mission

VISION

CARD MBA is a global leader in the microinsurance industry, owned and led by members upholding the core values of competence, family spirit, integrity, simplicity, humility, excellence and stewardship.

MISSION

-

To promote the welfare of marginalized sectors of the Philippine society and to other sectors as maybe determined by the Board;

-

To extend financial assistance to its members in the form of death benefits, medical subsidy, pension and loan redemption assistance;

-

To ensure continued access to benefits/resources by actively involving the members in the direct management of the association that will include implementation of policies and procedures geared towards sustainability and improved services;

-

To adopt a prudent cash management program to invest all cash in excess of current disbursement through a majority vote of its Board of Trustees.

CARD MBA as one of the MRI

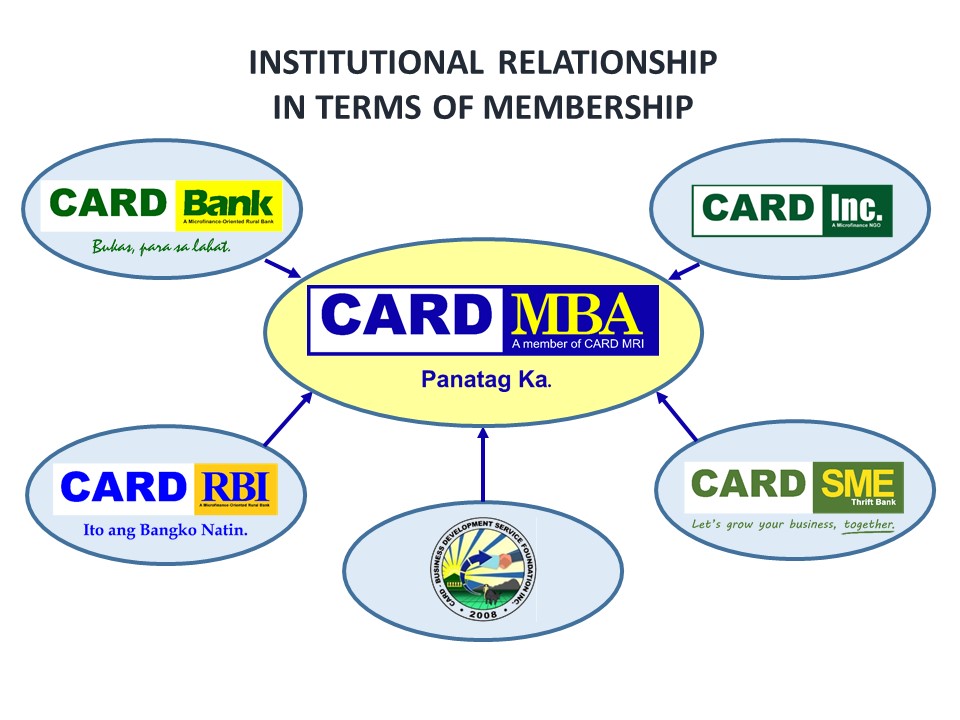

The CARD Mutually Reinforcing Institutions (CARD MRI) is a group of institutions with a common goal of becoming a world-class leader in microfinance and community-based social development undertakings that improve the quality of life of socially and economically challenged women and families towards nation-building. Through its twenty-three (23) institutions, it provides the financial and non-financial needs of poor women and their families.

The Center for Agriculture and Rural Development Mutual Benefit Association Inc. (CARD MBA) is the insurance arm of the CARD Mutually Reinforcing Institutions (CARD MRIs). It is a separate legal entity owned and managed by the CARD MRI borrowers, who, by the definition of a mutual benefit, are called “members of the association”. Members of CARD MRI’s financial institutions CARD Inc., CARD Bank Inc., CARD SME Bank Inc., and CARD MRI Rizal Bank, Inc. (CMRBI) are automatically enrolled with CARD MBA.

They pay a reasonably low premium for microinsurance, that when in times of sudden and unforeseen events such as accident, death, or disability the members can claim financial assistance from the association. There is also a retirement fund for the members and non-financial services such as mass weddings, relief assistance called the CARD MRI Disaster Relief Assistance Program (CDRAP), and Build-Operate-And-Transfer (BOAT) Program for Organized Groups (OGs) and Cooperatives.

CARD MBA, Inc., together with the different institutions of CARD MRI, works harmoniously with each other towards nation-building.

Institutional Background

CARD Mutual Benefit Association, Inc. started as an informal insurance-like activity called Members’ Mutual Fund (MMF). MMF was established by CARD in April 1994 for the primary purpose of loan redemption in case of the death of member-borrowers. It served as an in-house insurance arm of CARD providing death benefits for the members and their legal dependents aside from the loan redemption for member-borrowers.

In December 1996, the Pension Plan was implemented providing retirement, medical and disability benefits to members. This product became very popular with its member clients. Unfortunately, CARD had not adequately assessed the impact of this product on the institution. When an assessment was done, it showed that a member would have to pay premiums for two years just to cover one month of the benefit. Extrapolating from there, management realized that the whole institution was at risk and that fulfilling its obligation to members would completely diminish the CARD’s capital. Thus, the Pension Plan was stopped only after a couple of years of its implementation. From this incident, CARD’s management learned that an insurance business must be run by insurance professionals. Management also concluded that the insurance business should not be tied to the capital of a microfinance institution (MFI).

Management extricated CARD from this liability and transferred the assets of the fund to the members who then started a separate company with a separate Board. The management of the MMF was officially turned over to the members on September 9, 1999, during a two-day workshop held in San Pablo City and the fund assumed a new name, the CARD Mutual Benefit Association, Inc. or CARD MBA, a separate legal entity, non-stock, non-profit, owned and managed by the members.

Since then, products and services provided for the members are continuously increasing and innovating. From the primary purpose of loan redemption, CARD MBA now gives Basic Life Insurance Program, Golden Life Insurance Program, Credit Life Insurance Program, Retirement Fund, Remitter Protek Plan, Family Security Plan, Donated Benefits, Build-Operate-and-Transfer (BOAT) Program, Mass Wedding and Disaster Relief Assistance Program.

_________________________________________________________________________________________________

Funding Source and Investment

On December 31, 1999 the year when Members Mutual Fund (MMF) shifted to CARD MBA, the total asset of the institution was only Php 6.61 million. These assets have significantly increased to Php 23.7 billion as of December 31, 2020. The funds are invested in government securities and in time deposits.

Further, the funding of CARD MBA is mainly sourced from members’ weekly contributions. Each member contributes Php20.00 weekly (Php15.00 for Basic Life Insurance Program and Php5.00 for their Retirement Fund) to the Association for as long as she is a member. For Golden Life Insurance Program (optional program), each member contributes Php50.00 (option 1) or Php100.00 (option 2) weekly premium. In addition, for Family Security Plan (optional program), each member will pay Php1,000 premium per annum, and for Remitter Protek Plan (group life insurance and optional product), the center members will pay Php200 premium per annum.

Aside from the weekly contributions, another source of funds of the association is the 1.5% loan redemption fees being deducted from the proceeds of the loan under its Credit Life Insurance Program.

Board of Trustees

| Ms. Reazhyle A. Francisco | President |

| Ms. Babylita C. Mernilo | Vice President |

| Ms. Jenny A. Aquino | Treasurer |

| Ms. Emily Bagares | Trustee / Member |

| Ms. Virginia M. Garcia | Trustee / Member |

| Ms. Marissa S. Florendo | Trustee / Member |

| Ms. Dolores M. Mendoza | Trustee / Member |

| Ms. Deneglen C. Peñaflorida | Trustee / Member |

| Ms. Maribeth C. Magdato | Trustee / Member |

| Ms. Leny E. Saber | Trustee / Member |

| Ms. Cristy C. Sontosidad | Trustee / Member |

| Ms. Maria Dolores P. Tatel | Trustee / Member |

| Ms. Vida T. Chiong | Independent Trustee |

| Mr. Francis M. Puzon | Independent Trustee |

| Mr. Rolando A. Robles | Independent Trustee |

Advisory Committee

Ms. Lyneth Derequito

Ms. Juliana B. De Leon

Ms. Glenda C. Magpantay

Ms. Cynthia B. Baldeo

Ms. Glenda H. Atabay

Ms. Marie Sharon D. Roxas

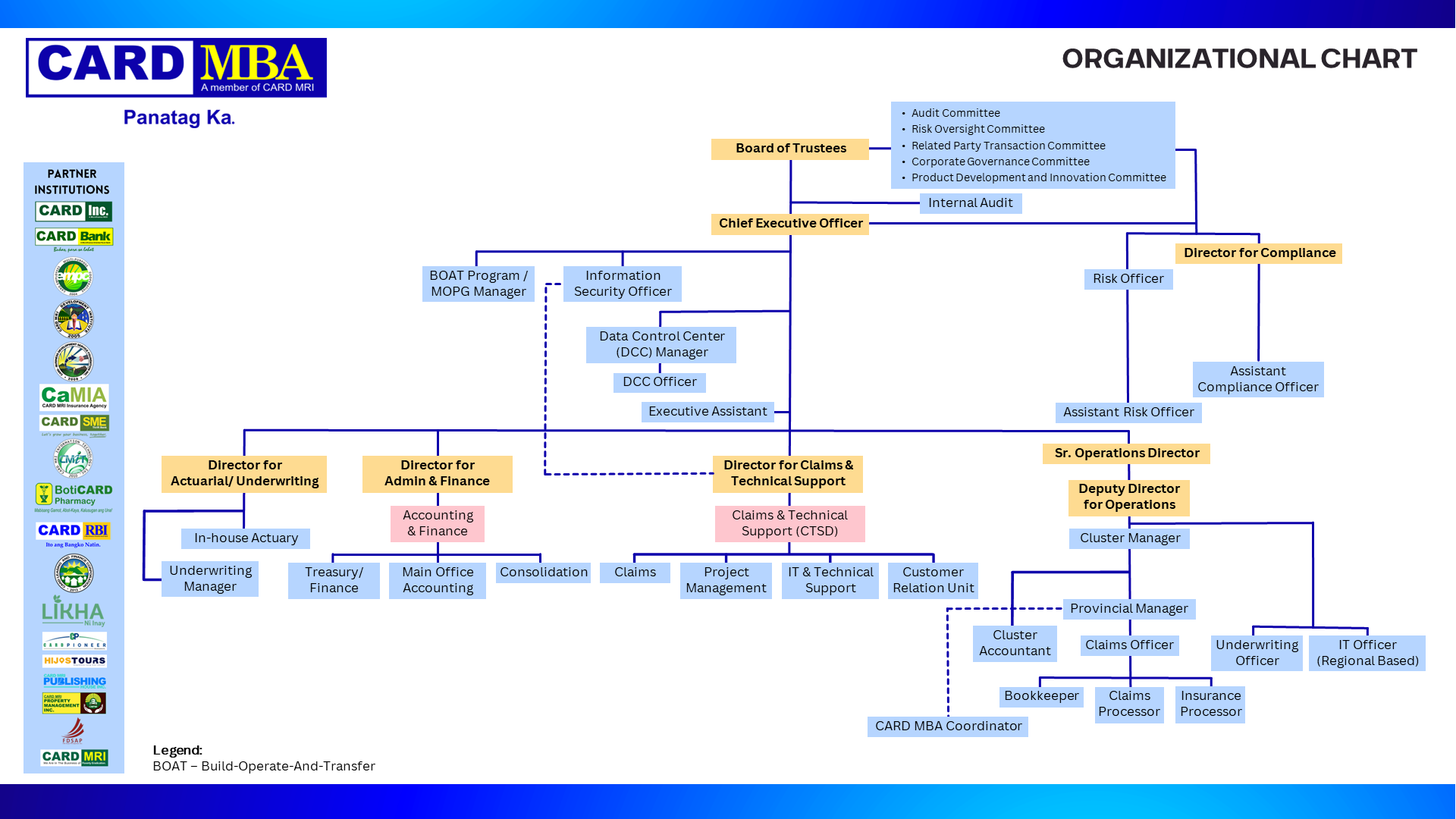

Management Team

MANAGEMENT COMMITTEE (ManCom)

Jocelyn D. DequitoChief Executive Officer |

||

Janet D. CaneoDirector for Admin and Finance |

|

Arlene R. UmandapDirector for Claims & Technical Support |

Oliver M. ReyesSr. Operations Director |

Gina A. NevadoDeputy Director for Operation (REGION 1) |

Janicekith N. NaveraDeputy Director for Operation (REGION 2) |

Francis R. MontillaDeputy Director for Operation (REGION 3) |

Ma. Joyce M. AlimagnoDeputy Director for Operations (REGION 4) |

Mauricio B. MaurDeputy Director for Operations (REGION 5) |

Nice Cornelia C. MacalaladDeputy Director for Operations (REGION 6) |

Roy P. JabonanDeputy Director for Operations (REGION 7) |

Catherine M. PataySr. Cluster Manager (REGION 8) |

Jennifer O. RedubloDirector for Compliance |

Michael Kelvin N. JunosDirector for Actuarial |

|

Awards & Recognition

2 GOLDEN ARROW AWARD

Top Performing Insurance Company (ACGS) 2022

CARD MBA was once again recognized as a 2-Golden Arrow Awardee scoring 95.53%. The 2-Golden Arrow Award is presented to insurance companies that garnered a score of 90-99 in the [2022] corporate governance scorecard assessment conducted by the ICD. CARD MBA is also part of the top-performing companies in Mutual Benefit Associations (MBAs) with regards to good corporate governance.

—————————————————————————————————————————————————-

2 GOLDEN ARROW AWARD

Top Performing Insurance Company (ACGS) 2021

CARD MBA was recognized as a 2-Golden Arrow Awardee scoring 94.68%. The 2-Golden Arrow Award is presented to insurance companies that garnered a score of 90-99 in the [2021] corporate governance scorecard assessment conducted by the ICD. CARD MBA is also part of the top-performing companies in Mutual Benefit Associations (MBAs) with regards to good corporate governance.

—————————————————————————————————————————————————-

2 GOLDEN ARROW AWARD

Top Performing Insurance Company & MBA (ACGS) 2020

Mutual benefit insurer CARD MBA, Inc. is one of the recipients of the ASEAN Corporate Governance (ACGS) 2-Golden Arrow Award by The Institute of Corporate Directors (ICD), a non-profit organization dedicated to the professionalization of corporate directorship. The award recognized CARD MBA’s commitment in ensuring balance and transparency in catering to its stakeholders’ needs and interests, as reflected in the 2020 ACGS Assessment and Scorecard garnering an average score of 98.72%

—————————————————————————————————————————————————-

Top Performing Insurance Company & MBA (ACGS) 2019

CARD MBA was awarded as one of the “Top Insurance Companies and MBA in the 2019” under the Asean Corporate Governance Scorecard (ACGS) last January 28, 2020 during the celebration of the Insurance Commission of their 71st Anniversary in PICC, Pasay City.

We are delighted as CARD MBA (top 6) and KASAGANA-KA MBA (top 11) bested other insurance companies and MBAs in the Philippines for the 2019 ASEAN Corporate Governance Scorecard.

Our CEO, Ms. May S. Dawat together with our CARD MBA President, Ms. Flordeliza C. Cristobal received the award on stage.

—————————————————————————————————————————————————-

1 GOLDEN ARROW AWARD

Top Performing Insurance Company (ACGS) 2018

CARD MBA was awarded as one of the “TOP PERFORMING Insurance Company in the Philippines 2018” under the Asean Corporate Governance Scorecard (ACGS) last June 11 in Pasay City.

——————————————————————————————————————————————————————————-

Microinsurance Plaque of Recognition

CARD MBA was recognized by the Insurance Commission for actively supporting Microinsurance initiatives in the Philippines during the celebration of the National Microinsurance Month last January 31, 2012, at the PICC CCP Complex, Roxas Blvd., Pasay City.